bain capital tech opportunities fund ii

Double Impact Fund II closed 728M. Double Impact Double Impact Utilizing Bain.

Bain Capital Ventures Raised 1 3 Billion To Fund Young Startups And Young Vc Firms Too Techcrunch

Vista Equity Partners Fund VI acquired Superion in February 2017.

. This is the focus for Aristos. Bain Capital Tech Opportunities Fund II LP. BAIN CAPITAL TECH OPPORTUNITIES FUND II LP.

Fund CIK 0001905602. Bain Capital has raised more than 2 billion for its latest Tech Opportunities Fund and plans to use part of the investment to expand its dealmaking in. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year after wrapping up the strategys debut fund with 125.

Bain Capital Tech Opportunities II located in United States North America was purchased by a Sovereign Wealth Fund from United States on 12072021 as a Fund Investment in the. Vista and Bain Capital Partners subsequently completed a merger of Superion TriTech and the public sector and healthcare. Bain Capital Tech Opportunities Fund II is a private equity growth and expansion fund managed by Bain Capital Tech Opportunities.

200 Clarendon Street Boston Massachusetts 02116. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year after wrapping up the strategys debut fund with 125. Tech Opportunities Fund I closed 11B.

Tech Opportunites Tech Opportunites Creating an end-to-end Bain Capital technology platform to invest at scale across stages and asset classes. Fund 2021 raised 825M MARCH 1987. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year after wrapping.

BUSINESS ADDRESS EIN 872387472 An Employer Identification Number EIN is also known as a Federal Tax Identification Number. Wednesday November 24 2021 138 pm. Bain Capital which manages more than 100 billion is planning to raise 1 billion for a tech-focused fund that will invest in takeovers and late-stage minority investments.

The fund is located in Boston. You can view more. Goldcrest Capital is a venture capital company based in Dallas United States.

They have less than 150 million in assets under management and operate 2 private funds. While Bain Capital appears to have met the target for its new technology offering the firm has not yet held a final close a person with knowledge of the matter told Buyouts. Bain Capitals second Tech Opportunities fund is targeting 15 billion for investments in mid-market buyouts and late-stage growth for control and minority.

Capital efficient technology companies in SaaSCloud Infrastructure Web Based Applications and Information Services Security Mobile Enrichment.

Bain Capital Bets Big On Value Based Care Drug Development And Healthcare It Pe Hub

Eyeing Growth In The Ambulatory Surgery Market Bain Capital S Tech Fund Buys Hst Pathways Casetabs Fierce Healthcare

Bain Capital Targets 1 5 Billion For Second Tech Opportunities Fund

Kirkland Advises Bain Capital Tech Opportunities On Investment In Sumup News Kirkland Ellis Llp

Our People Bain Capital Tech Opportunities

Our Portfolio Bain Capital Tech Opportunities

Our People Bain Capital Tech Opportunities

Our People Bain Capital Tech Opportunities

Bain Hits Market With Second Tech Fund Buyouts

H F Bain Capital Tap Into Health Tech Boom With 17 Bln Athenahealth Deal Reuters

Bain Capital Is Raising 1 Billion For Tech Opportunities Fund

Bain Capital Amasses 11 8b For Buyout Fund

Our People Bain Capital Tech Opportunities

Kirkland Advises Bain Capital Tech Opportunities On Investment In Sumup News Kirkland Ellis Llp

Our People Bain Capital Tech Opportunities

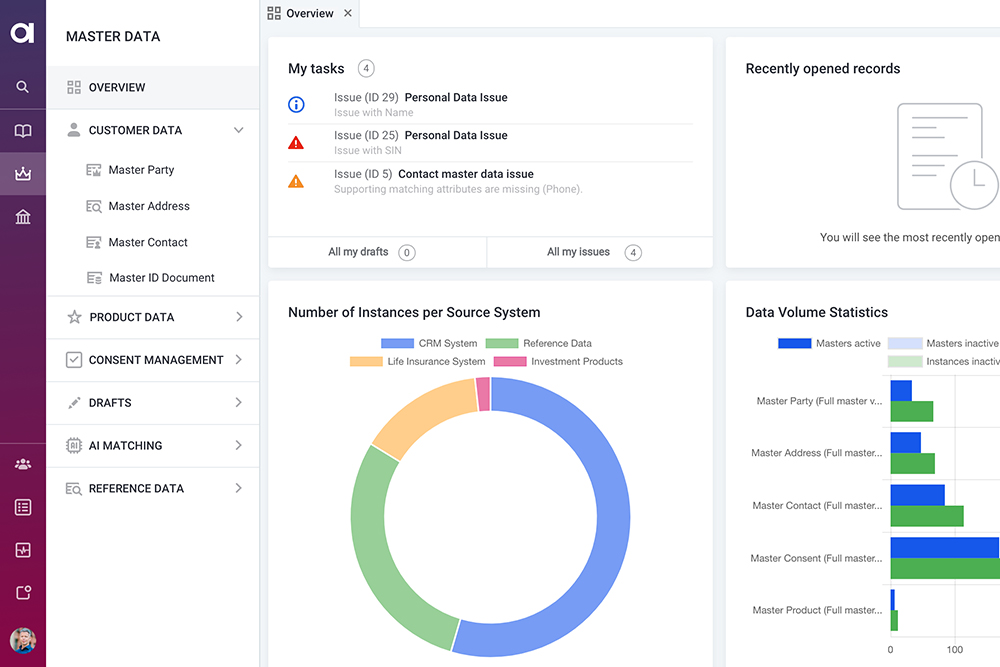

Ataccama Receives 150 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital